Debt Consultant Singapore: Specialist Solutions for Financial Administration

Debt Consultant Singapore: Specialist Solutions for Financial Administration

Blog Article

Check Out the Comprehensive Solutions Offered by Financial Debt Expert Provider to Help Individuals and Households Achieve Debt Recuperation Success

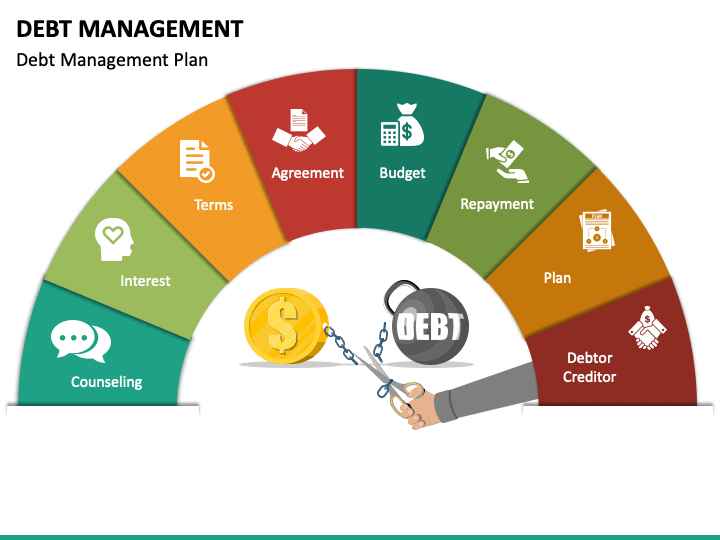

The monetary landscape for individuals and households grappling with debt can be complicated, yet financial debt consultant services present a structured method to navigate this complexity. By offering individualized financial assessments, customized budgeting approaches, and adept creditor arrangement strategies, these solutions deal with distinct scenarios and obstacles. Additionally, customers take advantage of continuous assistance and instructional sources that equip them to preserve lasting financial wellness. As we check out the elaborate solutions offered by these professionals, it ends up being vital to think about just how they can transform a tough monetary situation right into a manageable recovery plan.

Understanding Debt Specialist Solutions

Financial debt consultant solutions play an essential duty in helping companies and people navigate the complexities of monetary commitments. These services provide expert assistance and assistance tailored to the one-of-a-kind financial scenarios of customers. By evaluating the overall monetary landscape, financial debt experts can determine the underlying problems adding to financial obligation build-up, such as high-interest prices, bad budgeting, or unanticipated costs.

A crucial feature of financial debt professionals is to educate customers concerning their alternatives for managing and lowering financial obligation. This may entail negotiating with creditors to safeguard a lot more favorable terms or discovering debt combination approaches to streamline payments. In addition, specialists equip customers with the knowledge needed to make educated economic choices, promoting a much deeper understanding of financial obligation management principles.

The proficiency supplied by debt consultants prolongs beyond simple financial obligation decrease; they likewise play an essential role in developing lasting financial methods. By instilling self-control and advertising accountable investing behaviors, these specialists assist clients build a strong structure for future financial stability. Ultimately, financial debt consultant services function as an essential resource for people and organizations looking for to reclaim control over their financial health and attain enduring debt healing success.

Personalized Financial Assessments

A detailed understanding of a customer's monetary scenario is basic to effective financial obligation management, and individualized monetary evaluations are at the core of this procedure (contact us now). These assessments give a thorough overview of an individual's or household's financial landscape, including revenue, properties, costs, and obligations. By taking a look at these critical aspects, financial obligation consultants can recognize the special obstacles and chances that each client faces

Throughout a tailored monetary evaluation, professionals engage in in-depth discussions with customers to gather relevant info about their economic actions, goals, and problems. This info is then assessed to create a clear image of the client's current financial health and wellness. The process usually includes evaluating investing behaviors, identifying unnecessary expenses, and determining the influence of existing financial debts on overall economic security.

In addition, personalized monetary analyses allow specialists to determine possible locations for enhancement and establish reasonable economic goals. By tailoring their approach per client's certain scenarios, financial obligation professionals can develop workable approaches that align with the client's desires. Ultimately, these analyses function as an essential starting point for reliable debt recovery, laying the groundwork for notified decision-making and lasting financial administration.

Custom-made Budgeting Approaches

Reliable economic administration rest on the application of personalized budgeting approaches that accommodate individual demands and circumstances. These techniques are important for households and people striving to gain back control over their economic situations. A one-size-fits-all technique frequently falls short, as each individual's monetary landscape is unique, affected by earnings, expenses, financial obligations, and individual goals.

Debt specialist services play a critical duty in creating tailored budgeting strategies. At first, experts perform comprehensive analyses to identify revenue resources and categorize costs, differentiating between essential and optional you can look here investing. This allows clients to pinpoint locations where they can decrease prices and assign even more funds towards financial obligation payment.

Furthermore, personalized budgeting approaches incorporate reasonable monetary objectives, assisting clients set attainable targets. These objectives foster a feeling of responsibility and inspiration, crucial for maintaining dedication to the budget plan. Ongoing assistance and routine evaluations guarantee that the budgeting technique stays appropriate, adapting to any type of changes in personal priorities or financial circumstances.

Inevitably, customized budgeting methods equip individuals and families to take aggressive steps toward financial obligation recuperation, laying a strong structure for lasting economic stability and success.

Lender Settlement Techniques

Discussing with lenders can substantially minimize financial burdens and lead the way for even more manageable payment strategies. Efficient creditor settlement techniques can encourage people and families to achieve substantial financial debt relief without resorting to personal bankruptcy.

One fundamental strategy is to clearly recognize the monetary situation prior to initiating get in touch with. This includes gathering all pertinent information concerning financial obligations, rates of interest, and payment histories. With this data, the borrower can provide an engaging situation for negotiation, highlighting their desire to repay while highlighting the challenges they deal with.

An additional method includes recommending a reasonable settlement plan. Providing a lump-sum repayment for a minimized total balance can be attracting creditors. Additionally, recommending reduced regular monthly repayments with extensive terms may assist alleviate capital concerns.

Furthermore, preserving a considerate and calm temperament during settlements can promote a participating ambience. When come close to with expertise and politeness., financial institutions are more likely to consider propositions.

Ongoing Assistance and Resources

Recurring support and resources play an important role in helping individuals navigate their economic recuperation trip post-negotiation. After efficiently negotiating with creditors, clients frequently require additional advice to preserve their recently restored financial security. Financial debt expert services supply continual support through various methods, making certain that people stay on course toward achieving their economic objectives.

Furthermore, numerous financial debt experts supply customized follow-up examinations, enabling clients to receive and go over continuous difficulties tailored suggestions. This continuous relationship assists clients stay responsible and determined as they work in the direction of long-lasting economic healing.

Moreover, access to online devices and resources, such as budgeting applications and credit rating tracking solutions, improves clients' capacity to manage their funds effectively - contact us now. By incorporating education and learning, individualized assistance, and useful devices, debt expert solutions equip family members and individuals to accomplish and maintain lasting monetary recuperation

Verdict

With personalized financial evaluations, customized budgeting strategies, and expert lender negotiation techniques, these solutions properly resolve distinct monetary challenges. The comprehensive remedies used by financial obligation specialists ultimately foster financial security and accountable spending habits, leading the method for a more safe and secure monetary future.

Report this page